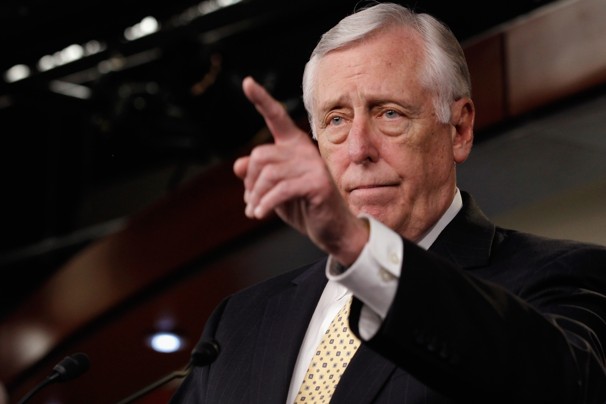

House Minority Leader Steny Hoyer (D-Md.) was one of several Democrats who opposed legislation on Wednesday to fire federal workers with large outstanding tax debts.

Employees of the federal government dodged a bullet Wednesday, as the House failed to pass legislation that would require federal workers to be fired if they fail to pay their federal taxes.

Republicans called up the legislation just weeks after the IRS reported that more than 100,000 federal workers owed about $1.1 billion in unpaid taxes as of last year. The bill’s sponsor, Rep. Jason Chaffetz (R-Utah), said Congress needs to send the message that it’s a privilege to be a federal worker, and that all of them must pay their taxes.

If you’re a federal worker thumbing your nose at the federal government, not paying your taxes, then you should be eligible to be fired by the supervisor,” he said.

But Democrats opposed the bill, and said that despite the IRS’s own report, there is no problem at all with delinquent tax debts.

“This measure is based on ideology rather than facts, and will perpetuate a negative image of federal workers,” said Rep. Elijah Cummings (D-Md.).

Chaffetz Plan to Fire Federal Workers With Big Tax Debts Fails in the House

Postal Workers had a 3% delinquency rate but the greedy, selfish hypocrites in the House of Representatives had a 5% delinquency rate. They should fire themselves first and then consider everyone else!!!

Non payment of taxes is a crime. Fire the criminals and put them in jail.

I dutifully pay my taxes, but sometimes I think the tax system is in dire need of reform. So I have a proposal to prompt considerations of reform.

Let’s forbid automatic withholding for say two years. For two years, let’s require Joe Six-Pack, or Melvin Mail Handler to write a check in April for his federal income tax. If a Postal Service employee and spouse owes $25,000 in federal income tax, let’s let them write a check for the $25,000 instead of incrementally withholding it.

I wonder what would happen if there was no withholding for two years and the tax payers were made painfully aware of their true tax burden. I wonder. The silent majority, who pay the taxes, might suddenly become very politically active and interested in tax reform.

ABSOLUTELY…!