U.S. GAO Report– U.S. Postal Service: Improved Management Procedures Needed for Parcel Select Contracts

Here are excerpts from the report:

The package delivery market is growing and changing rapidly. In 2013, U.S. businesses and consumers reportedly spent more than $68 billion to ship packages domestically using the three largest national package delivery providers in the U.S.—United Parcel Service (UPS), Federal Express Corporation (FedEx), and USPS. This spending is driven in large part by recent growth in electronic commerce, which is forecast to grow in the double digits year-over-year to bring electronic commerce’s share of overall U.S. retail sales to almost 9 percent, or $490 billion, by the end of 2018. According to USPS, revenues from its Shipping and Packages services—which includes Parcel Select—have grown from about $11.6 billion in fiscal year 2012 to over $13.7 billion in fiscal year 2014, and generate about 20 percent of USPS’s total operating revenues.

As the package delivery market has changed, USPS must manage complex business relationships with its competitors. For example, although UPS and FedEx both pay USPS to deliver packages the last mile under certain circumstances, they also compete with USPS for end-to-end package delivery business—a concept that USPS officials refer to as “coopetition”. Similarly, FedEx is USPS’s largest contractor providing air transportation for Priority Mail Express (formerly Express Mail), Priority Mail, and First-Class Mail. UPS also is one of USPS’s largest contractors providing long-distance mail transportation.

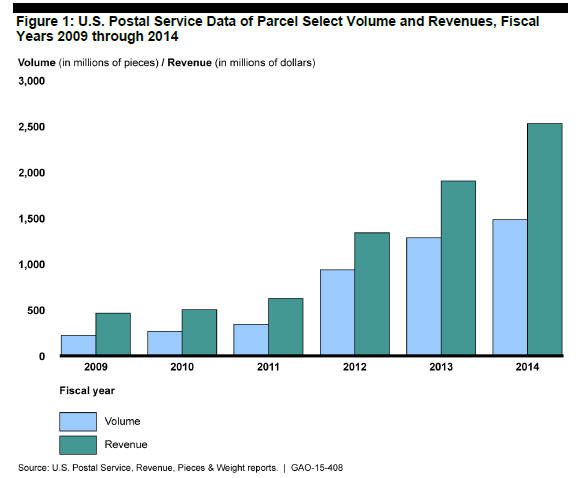

USPS uses Parcel Select NSAs to encourage additional mail volume and revenue by providing mailers with discounted prices in exchange for meeting the contract’s terms and conditions. USPS data show that the Parcel Select product, including Parcel Select NSAs, is an increasingly important source of additional volume and revenue.

While USPS uses Parcel Select NSAs to generate additional revenue, among other benefits, mailers use them to lower delivery costs and to take advantage of USPS’s extensive “last mile” network that serves more than 140 million residential delivery points 6 days a week.

While USPS uses Parcel Select NSAs to generate additional revenue, among other benefits, mailers use them to lower delivery costs and to take advantage of USPS’s extensive “last mile” network that serves more than 140 million residential delivery points 6 days a week.

USPS has a universal service obligation, part of which requires it to provide delivery service to all communities, 39 U.S.C. § 101(a) et. seq. A single residential delivery point can serve multiple addresses, such as centralized delivery at apartment buildings. USPS maintains data on the number of delivery points rather than addresses. According to USPS data, residential delivery points have increased from about 137 million in fiscal year 2009 to about 141 million in fiscal year 2014. USPS also delivers packages on Sunday under a Parcel Select NSA. According to the USPS’s Office of Inspector General, at the end of April 2014, Sunday service was operating at 459 Postal Service Destination Delivery Units or hubs and USPS had delivered 2.7 million parcels to customers on Sunday from these locations. See USPS Office of Inspector General, Sunday Parcel Delivery Service, Report number DR-AR-15-002 (Arlington, VA: December 5, 2014). Contracts may require the mailer to ship a minimum volume of packages each contract year (minimum volume requirement) to qualify for discounted prices. Some contracts may require the mailer to pay USPS the difference between the discounted price and published price for Parcel Select if the mailer fails to meet this minimum volume requirement.

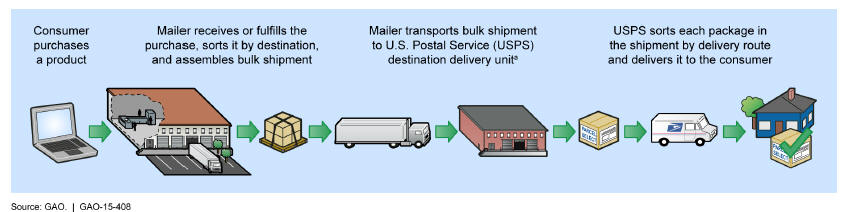

Shipping packages under Parcel Select lowers mailers’ delivery costs by allowing them to enter bulk shipments of packages into USPS’s network—generally at Destination Delivery Units (DDU)

Figure 2: Package Delivery Flow under Parcel Select Negotiated Service Agreements that are located close to the final delivery point (see fig. 2). As a result, these packages generally bypass most of USPS’s mail processing and transportation network. Prices vary, depending on package weight, entry point, and the total volume shipped.

USPS must ensure that all Parcel Select NSAs comply with statutory requirements under the Postal Accountability and Enhancement Act (PAEA).

Published prices are the rates of general applicability that USPS charges the general public and are published in the Domestic Mail Manual. These rates are established by USPS and approved by the PRC. Notably, each Parcel Select NSA is required to generate enough revenue to cover its attributable costs.

For Parcel Select, these costs primarily include USPS labor involved in sorting packages at postal facilities and delivering them to the final delivery point. PRC reviews each Parcel Select NSA to ensure that it is projected to comply with this and other requirements before USPS can implement it. According to PRC, this pre-implementation review is justified to preserve fair competition.

What GAO Found

In June 2014, the U.S. Postal Service (USPS) established standard procedures that departments should follow to manage all negotiated service agreement (NSA) contracts, including Parcel Select NSAs. Although the procedures, in part, address some leading contract management practices, such as defining performance management activities, they lack documentation requirements and clearly defined management responsibilities for some activities. For example, the procedures do not require USPS to document some key management decisions, such as USPS’s decision to forego additional revenue when a mailer did not ship a minimum volume of packages, as contractually required. Documenting such information could improve future decision making and enhance accountability for the effective and efficient use of USPS resources. USPS acknowledged that the procedures contained gaps when they were initially established. Reviewing and updating the standard procedures to include documentation requirements and clearly defined management responsibilities would provide additional assurance that USPS’s Parcel Select NSAs are effectively managed.

USPS’s costing method for Parcel Select NSAs does not account for package size or weight or use contract-specific cost estimates. Each Parcel Select NSA is required to earn sufficient revenues to cover USPS’s costs—referred to as “attributable costs” in the postal context. The Postal Regulatory Commission (PRC), which annually reviews compliance, determined that each contract met this requirement. However, USPS’s analysis of attributable costs for Parcel Select NSAs is limited, because USPS has not studied the impact of package size or weight on specific contracts or developed contract-specific cost estimates.

- Package size and weight information : USPS does not collect information on the size of NSA packages and has not studied the impact of package size and weight on USPS’s delivery costs for specific contracts. However, larger and heavier packages can increase USPS’s costs. For example, carriers must walk packages that are too large for a centralized mailbox to the customer’s door, which increases costs. Moreover, mailers use size and weight to inform their own business decisions. For example, one mailer continually assesses package size and weight to make cost-effective decisions about the delivery method it chooses. If mailers route larger or heavier packages via Parcel Select, collecting and studying such information could improve USPS’s analysis of attributable costs for Parcel Select NSAs.

- Contract-specific cost estimates : USPS’s method to determine attributable costs uses average cost estimates for the Parcel Select product instead of contract-specific cost estimates. USPS’s use of averages further limits its analysis of the extent to which each Parcel Select NSA covers its attributable costs, because USPS had not studied the extent to which the size and weight of packages shipped under individual contracts deviated from the characteristics of packages USPS used to estimate the average.

USPS officials questioned whether the benefits of developing contract-specific cost estimates would exceed the costs; however, USPS has used less intensive methods, such as sampling, to improve estimates for other products in the past.

What GAO Recommends

GAO recommends that USPS update its standard procedures to address gaps in documentation requirements and contract management responsibilities. Also, USPS should identify cost-effective methods to collect and study information on delivery costs for Parcel Select packages of varying characteristics to develop contract-specific attributable cost estimates. USPS agreed with these recommendations, but stated that the cost impact of package size and weight is likely small given where these packages enter the mail stream.

See Full GAO Report (PDF, 37 pages)