USPS Fiscal Year 2015 Integrated Financial Plan (excerpts)

USPS Fiscal Year 2015 Integrated Financial Plan (excerpts)

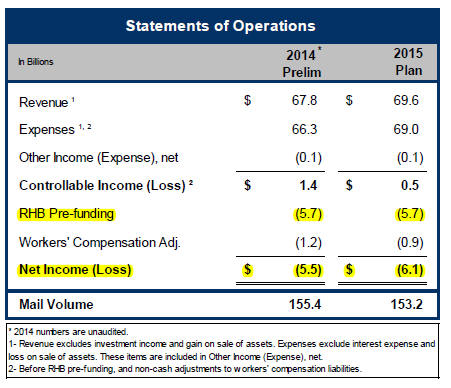

The FY2015 IFP projects controllable income of $0.5 billion (as shown on the table to the right), versus a controllable income of $1.4 billion in FY2014. Controllable income excludes retiree health benefits (RHB) pre-funding and non-cash adjustments to workers’ compensation. All revenue and controllable income comparisons to FY2014 in this document will be defined as shown in the table on the right.

The FY2015 planned controllable income reflects continuing efforts to increase revenue and reduce costs. The IFP projects revenue growth of $1.8 billion, or 2.7 percent, compared to FY2014 and would mark the third consecutive year of revenue increase.

The IFP includes a reduction of 5 million work hours, largely as a result of continued efforts to right-size the network and operating window to align with the current and projected mailing landscape, and ongoing PostPlan savings. However, these savings will not be sufficient to offset inflationary and other cost increases and our total expenses will grow in FY2015. The Postal Service has already made significant strides in increasing the efficiency of its operations, resulting in a reduction of 352 million hours since 2006. Without comprehensive legislation to reduce the delivery frequency of non-parcel mail and additional improvements to the outdated business model, future productivity gains will likely be incremental.

The FY2015 net loss is forecasted to be $6.1 billion, including $5.7 billion of legally mandated pre-funding for retiree health benefits and an estimated $0.9 billion of non-cash impact to the long-term workers’ compensation liability. There is no estimate included in the plan however for the portion of workers’ compensation liability that changes with interest rates, as it is too volatile to reliably forecast.

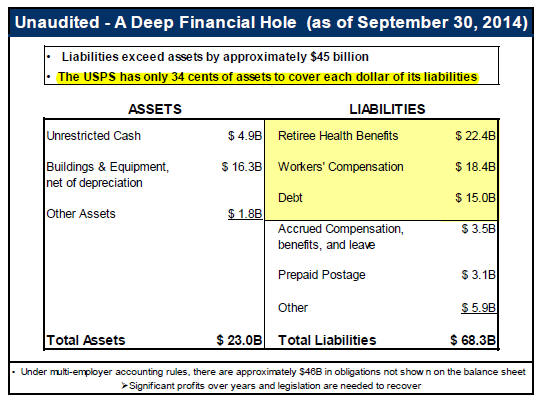

Even after defaulting on retiree health benefits pre-funding payments of $11.1 billion in FY2012, $5.6 billion in FY2013 and the $5.7 billion in FY2014, the Postal Service ended FY2014 with an unrestricted cash balance of just $4.9 billion, which equates to only approximately 19 days of operating cash. There is also no remaining borrowing capacity, as we ended the year with $15 billion in debt, which is the legally-mandated ceiling. Even with strong revenue growth in FY2015, our liquidity will not improve, and we will not be able to pay the pre-funding payment due in FY2015, pay for any of the defaulted amounts from prior years, or significantly pay down debt.

There can be no assurance that Congress will enact comprehensive legislation that will impact the Postal Service in FY2015 or future years. Accordingly, the FY2015 IFP does not reflect any benefits associated with potential legislative changes

Many of the structural reforms needed to ensure long-term financial viability, such as the resolution of our excessive RHB pre-funding payment schedule and changes to delivery frequency, can only be achieved with comprehensive legislation.

2015 OPERATING PLAN –WORK HOURS & EXPENSES

Total work hours were 1,107 million in 2014, and represented a 3 million work hour decline, or 0.3 percent, compared to 2013. The 2015 IFP projects total work hours of 1,102 million and a work hour reduction target of 5 million, or 0.5 percent. This includes the savings from phase II of Network Rationalization and the continuation of the PostPlan and load leveling initiatives. However, these savings are partially offset by the expected increase in package volume and the expansion of the customer care center.

Postal Service initiatives and efforts to align with the changing economic and mailing environment have resulted in a reduction of 352 million work hours since 2006. While we continue to develop initiatives to streamline operations and reduce work hours as noted above, it will be increasingly challenging to reduce work hours at the historical pace without comprehensive legislation, as the number of delivery points continues to increase and the requirement to deliver non-parcel mail six days a week remains in place. The continued volume growth in packages, estimated at 13.1 percent in 2015, will also increase work hours. Efforts to continue to right-size the network and improve operational efficiency will continue, but the magnitude of work hour reductions diminishes as major efficiency gains have already been achieved.

Non-personnel expenses are expected to grow, as we invest in information systems and communications software to support our growth initiatives and tracking capabilities. We must also make needed repairs to our aging vehicles and facilities. In addition, there are also some increases in non-personnel costs associated with phase II of Network Rationalization. This moderate expense growth is necessary to achieve the operational savings discussed previously. Transportation costs are expected to grow slightly in 2015, as savings from our surface transportation cost-reduction initiatives are offset by costs associated with the network consolidations, additional package volume, and inflation.

The 2015 IFP reflects the Postal Service’s continued strides toward financial health and stability, within the limits of current law. The IFP projects growth in revenue of $1.8 billion. In conjunction with its revenue growth initiatives, the Postal Service continues to right-size its network and maximize utilization of its more flexible non-career workforce to align with the changing mailing environment.

Despite revenue growth initiatives and continued rationalization of our network, the Postal Service will still have insufficient liquidity to make the $5.7 billion RHB pre-funding payment or make a meaningful reduction in debt. Although our controllable income, as shown on page one, is estimated to be positive, significant risks such as negative economic developments, continued fiscal uncertainty of the U.S. government, inflation in fuel or wages, etc. could swiftly eliminate that positive controllable income. Our $52 billion of net losses over the previous eight years were driven significantly by $40 billion in mandated RHB pre-funding. These losses have consumed our cash and borrowing capacity to the point where we have defaulted on our RHB pre-funding obligations the past 3 years and expect to default on the RHB pre-funding payment in 2015.

We continue to inform the Administration, Congress, the Postal Regulatory Commission, and other stakeholders of the immediate and longer-term financial issues we face and the comprehensive legislative changes that would help provide financial stability. Given the vital role the Postal Service plays in the U.S. economy, a financially healthy and stable Postal Service should continue to be a top priority for all stakeholders from legislative and regulatory bodies to management, employees, and customers.

USPS Fiscal Year 2015 Integrated Financial Plan

Everyone needs to look at the fact that since 06 the postal service has admitted to cutting over 300 million work hours a year that means that we have a few hundred thousand less workers then we had and are still functioning, so if we are working with less people now then the amount of money we should be paying for the pre-funding should have been reduced to reflect the actual number of future employees. That would eliminate the debt we owe and bring us back to the black instead of fearing a bailout or bankruptcy due to imaginary people that may retire in 75 years. Congress just need to pay attention to what they are arguing about to see that reality doesn’t equal fantasy. The Postal Service should just stay the way it is and drop the pre-fund so they can move on with business. A survey showed that they are the most trusted government entity, yet everyone seems to fear that they may end up costing taxpayers money like the rest of the government.

Anyone else notice that no matter how many consolidations we make, people we get rid of, hours we reduce, overtime we cut, additional revenues we bring in, ventures w/ other companies we organize…we’re always in danger of being broke. Year after year after year of reductions and cost-cutting and it’s the same old story.

Where exactly are all these “savings” going? We could be down to one plant, one supervisor, and one casual and they’d still find a way to blow the money.

when you have an agency with a total employee count of 431,000, you do not need over 100,000 postal mismanagers and 45 Vice-Presidents-its a drain on payroll…………..the difference from being in the black to dripping red ink. from making a profit to losing billions of dollars a year. ( they are very good at losing billions, at least they do something well lol)

here we go again……. Post office: “we’re broke”……..Unions: “we’re making money”……. Post Office: “no we’re broke, just look at the numbers”……. Unions: “no we’re making money, just look at the numbers” and the game continues………..