From the USPS Office of Inspector General:

The Office of Inspector General for the U.S. Postal Service has released a new white paper exploring a series of potential approaches the Postal Service could take for expanding its financial services offerings. The report is a follow up to a January 2014 white paper on non-bank postal financial services that generated significant interest from consumer advocates, policymakers, and the media. Both reports explore how the Postal Service could provide affordable financial options for the 68 million financially underserved Americans who either don’t have a bank account, or who have an account but also rely on often expensive alternative financial services like check cashing and payday lending. While the first paper was largely conceptual, the new report examines specific approaches in more detail.

The Office of Inspector General for the U.S. Postal Service has released a new white paper exploring a series of potential approaches the Postal Service could take for expanding its financial services offerings. The report is a follow up to a January 2014 white paper on non-bank postal financial services that generated significant interest from consumer advocates, policymakers, and the media. Both reports explore how the Postal Service could provide affordable financial options for the 68 million financially underserved Americans who either don’t have a bank account, or who have an account but also rely on often expensive alternative financial services like check cashing and payday lending. While the first paper was largely conceptual, the new report examines specific approaches in more detail.

The Postal Service has long been a major player in alternative financial services, or AFS. Money orders are by far the most widely used type of AFS, according to the FDIC. And the Postal Service, which has more than 30,000 retail locations, is the largest single provider of money orders, selling 97 million of them in fiscal year 2014 worth a face value of $21 billion. It also offers international money transfers, prepaid gift cards, and limited check cashing. Many of the roughly 13 million people who buy postal financial products each year are regular, repeat customers. And if the Postal Service offered additional products, they could be very popular, according to 2014 research from The Pew Charitable Trusts which found that between 59 percent and 81 percent (depending on the specific product) of current AFS users say they would be likely to go to their local post office to buy lower cost financial products. Pew’s research also shows that Americans across the political spectrum support the idea of expanded postal financial services, agreeing that the benefits to low-and-middle-income Americans and the Postal Service outweigh concerns that it would divert resources away from mail delivery or give the Postal Service an unfair advantage over private businesses.

The OIG, which is independent from the Postal Service, hired financial consultant Mercator Advisory Group to assist with the analysis, which is meant to inform the Postal Service and other stakeholders as they explore potential opportunities. The OIG is not making an official recommendation, though it acknowledges that a first logical step for the Postal Service may be to improve and expand on the products it can likely provide under current law. That may include payroll check cashing, electronic domestic money transfers between post offices, international money transfers, walk up bill pay, money orders, ATMs, and gift cards — though the Postal Regulatory Commission would ultimately decide whether to approve any product expansions. After a five-year ramp up, these products alone could generate an estimated $1.1 billion in annual revenue and contribute worthwhile profits for the Postal Service.

Other products, including small loans, reloadable prepaid cards, and checking or savings accounts, are likely outside the Postal Service’s current legal authority. If its authority was expanded, it could stand to gain significantly more revenue and could make a more meaningful impact on financial inclusion. The report explores four ways the Postal Service could go about executing this type of expansion, including through partnerships with one or more financial institutions, perhaps including banks, credit unions, and non-bank financial players. The report also explores the possibility of creating a marketplace through which the Postal Service could distribute the products of a wide variety of financial providers. This could be a way to bring scale to consumer friendly products that might lack the backing of major financial players. Finally, the OIG examines the possibility of the Postal Service becoming a licensed bank, which would be the most time consuming, challenging, and risky approach on multiple levels. That said, this approach also could have the highest potential for benefitting the financially underserved.

The report also discusses the Postal Service’s advantages in the alternative financial services space, provides high level strategic considerations, and gives detailed revenue projections for products that may be allowable under current law.

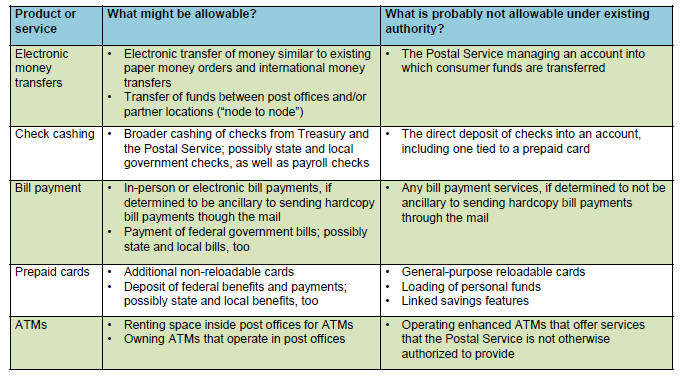

WHICH PRODUCTS CAN THE POSTAL SERVICE PROVIDE UNDER CURRENT LAW?

While current law limits the Postal Service’s authority to offer new products, it can make proposals to its regulator to move into adjacent products. Whether proposals gain approval depends on many factors, including the strength and quality of the proposals and the opinions of the regulator’s commissioners. While there are no definitive answers and approval is not guaranteed, we do have some educated guesses as to which products may be good candidates for expansion under current law. Note that this analysis does not constitute a legal decision or opinion.